In this post, I will look into mining profitability and how you might measure it. There are many aspects to measuring profitability and it is impossible to say if I mine for a year, I will make $ XY.

Your profitability will be determined by the following:

- what you mine – bitcoin, ethereum, etc.

- crypto price fluctuation – 1 bitcoin will cost different amount on a Tuesday and Wednesday

- where you mine – cloud vs owned hardware

- price of electricity – mining uses a lot of power

- mining difficulty – an ever so changing constant based on the amount of total hashing power

In order to explore all of these options, let’s consider the 3 major mining types and see how you would go around calculating profitability.

Cloud mining

I am intentionally starting with cloud mining as it is the most straight forward process. I will be using Hashflare to demonstrate how to calculate the profitability as it is one that currently accepts contracts. You can however use the same methodology for any other cloud mining service. Also, please note that these numbers were valid at the time of writing and they might have changed when you are reading this post.

In order to calculate the profitability, the following assumptions were made:

- We are mining bitcoin, even though the site lets you mine other cryptos as well

- Bitcoin price is $14 000

- $2.2 USD is the price per gigahash

- 1000GHs (1THs) purchased

- Contracts last a year

- Price of bitcoin will not change

- Mining difficulty will not change

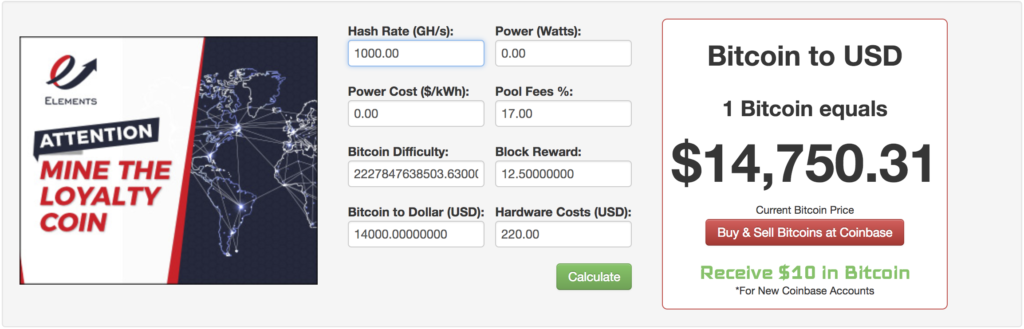

The best way to go around these calculations is to have a look at the mining calculator website.

For Hashflare, enter the following settings:

Now, if we look at the numbers, it will take 167 days to break even. Anything after that will be profit. So for the price of $220, you will earn $220 in 167 days. In 1 year, you will have made $479. The profit would therefore be $479-$220 = $250 in a year.

Now let’s look at the reinvesting option, which there are infinite number of strategies – the easiest one to calculate would go something like this:

- wait 167 days, reinvest all earnings

- wait another 167 days, reinvest all earnings

- wait another 167 days, reinvest all earnings

So after 167 days, you will have $220USD, you reinvest and get 2THs in total. At the end of the year (for rounding purposes 167days is 1/2 a year. It is actually less but it won’t matter much). you will have $479USD again. You can use this to purchase another 2THs. One will however expire, so you will have 3THs. In the next 6 months, you would make $ 718 this time. Whether you continue building mining power, or withdraw money is up to you at every stage. Just make sure you are not losing money.

Mining with graphic cards

Mining with graphics cards has an advantage over cloud mining in terms of profitability since you can choose which crypto currency you mine. You can either use something like Nicehash that will calculate profitability for you and pay you out in bitcoin on daily basis. However, there is a second option. You can use a website like what to mine.

The beauty of mining with GPU is that you can switch between different cryptos instantly. You will be able to mine ethereum one day. If ethereum becomes less profitable, you can mine zcash the next day. The amount of flexibility with GPU is amazing.

Mining with ASIC

When mining with ASIC, it is something between cloud mining and GPU mining. You can again use the extremely useful what to mine website to see what the best option is to mine. ASIC has much less flexibility to switch crypto you mine from one to another but you are still more flexible than with the cloud.